are funeral expenses tax deductible in california

Not all estates are large enough to qualify to be taxed. Individual taxpayers cannot deduct funeral expenses on their tax return.

Are Medical Expenses Tax Deductible Community Tax

Tuition and fees deduction.

. Can I deduct funeral expenses probate fees or fees to administer the estate. Funeral expenses documents receipts funeral home contract etc that include the applicants name the deceased persons name the amount of funeral expenses and the dates the funeral expenses. In other words funeral expenses are tax deductible if they are covered by an estate.

Qualified medical expenses include. While the IRS allows deductions for medical expenses funeral costs are not included. That depends on who received the death benefit.

Who reports a death benefit that an employer pays. Enter the larger of line 1 or line 2 here 3. Deductible medical expenses may include but are not limited to the following.

Estates however are able to deduct funeral costs from taxes. Student loan interest deduction. The IRS deducts qualified medical expenses.

Enter amount shown for your filing status. But extra copies of the death DVD that are given to. These expenses may be deductible for estate tax purposes on Form 706.

No never can funeral expenses be claimed on taxes as a deduction. Funeral Costs Paid by the Estate Are Tax Deductible While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs. These are personal expenses and cannot be deducted.

Funeral expenses are not tax deductible because they are not qualified medical expenses. Single or marriedRDP filing separately enter 4601 MarriedRDP filing jointly head of household or qualifying widow er enter 9202 4. The taxes are not deductible as an individual only as an estate.

They are never deductible if they are paid by an individual taxpayer. But this isnt applicable to every estate. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

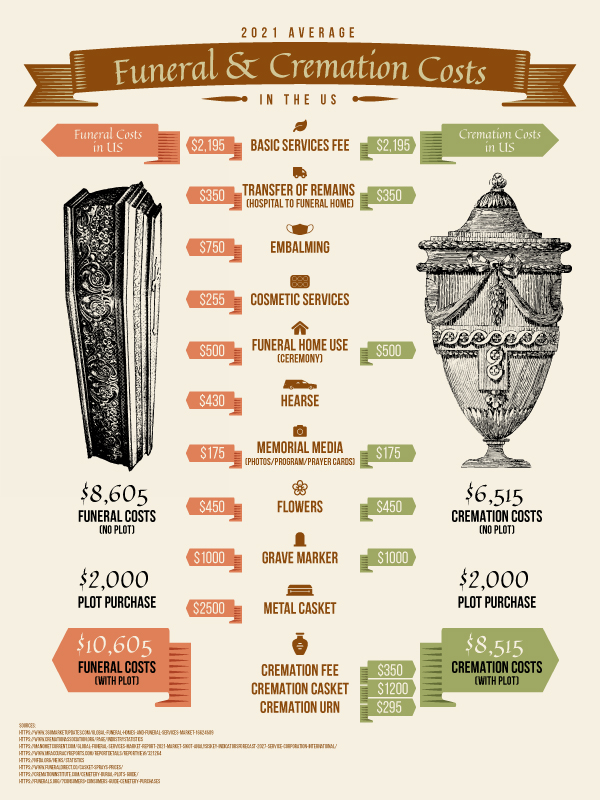

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. This cost is only tax-deductible when paid for by an estate. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. Any individual even the ones who personally paid out-of-pocket will not be able to claim funeral expenses on his or her taxes. According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return.

Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Enter the smaller of line 3 or line 4 here and on Form 540 line 18. No deduction for funeral expenses can be taken on the final Form 1040 or 1040-SR of a decedent. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

This is only applicable to estates that pay taxes and in order for an estate to be required to pay taxes it must have a minimum gross value of 1158 million. If the IRS requires the decedents estate to file an estate tax return the estates representative may be able to include funeral expenses as a deduction. If any funeral cost is relevant to the ceremony or burial and is a reasonable part of the service it is eligible to be deducted.

Minimum standard deduction 2. This may include the costs of hiring a funeral director embalming and preparation fees and internment of the body. In short these expenses are not eligible to be claimed on a 1040 tax form.

Its preparation is considered part of a funeral service and under state law funeral services arent taxable. A death benefit is income of either the estate or the beneficiary who receives it. Rules for Claiming Funeral Expense Tax Deductions The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. Deducting funeral expenses as part of an estate. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

Qualified medical expenses must be used to prevent or treat a medical illness or condition.

Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents

Are Medical Expenses Tax Deductible Community Tax

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Can I Deduct Funeral Expenses From My Income Taxes Debt Com

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

California Funeral Burial Insurance Costs Faqs Etc Lincoln Heritage

Are Medical Expenses Tax Deductible Community Tax

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021